McKinsey technology trends outlook 2024

DOWNLOADS

McKinsey technology trends outlook 2024

Despite challenging overall market conditions in 2023, continuing investments in frontier technologies promise substantial future growth in enterprise adoption. Generative AI (gen AI) has been a standout trend since 2022, with the extraordinary uptick in interest and investment in this technology unlocking innovative possibilities across interconnected trends such as robotics and immersive reality. While the macroeconomic environment with elevated interest rates has affected equity capital investment and hiring, underlying indicators—including optimism, innovation, and longer-term talent needs—reflect a positive long-term trajectory in the 15 technology trends we analyzed.

What’s new in this year’s analysis

This year, we reflected the shifts in the technology landscape with two changes on the list of trends: digital trust and cybersecurity (integrating what we had previously described as Web3 and trust architectures) and the future of robotics. Robotics technologies’ synergy with AI is paving the way for groundbreaking innovations and operational shifts across the economic and workforce landscapes. We also deployed a survey to measure adoption levels across trends.

These are among the findings in the latest McKinsey Technology Trends Outlook, in which the McKinsey Technology Council identified the most significant technology trends unfolding today. This research is intended to help executives plan ahead by developing an understanding of potential use cases, sources of value, adoption drivers, and the critical skills needed to bring these opportunities to fruition.

Our analysis examines quantitative measures of interest, innovation, investment, and talent to gauge the momentum of each trend. Recognizing the long-term nature and interdependence of these trends, we also delve into the underlying technologies, uncertainties, and questions surrounding each trend. (For more about new developments in our research, please see the sidebar “What’s new in this year’s analysis”; for more about the research itself, please see the sidebar “Research methodology.”)

New and notable

The two trends that stood out in 2023 were gen AI and electrification and renewables. Gen AI has seen a spike of almost 700 percent in Google searches from 2022 to 2023, along with a notable jump in job postings and investments. The pace of technology innovation has been remarkable. Over the course of 2023 and 2024, the size of the prompts that large language models (LLMs) can process, known as “context windows,” spiked from 100,000 to two million tokens. This is roughly the difference between adding one research paper to a model prompt and adding about 20 novels to it. And the modalities that gen AI can process have continued to increase, from text summarization and image generation to advanced capabilities in video, images, audio, and text. This has catalyzed a surge in investments and innovation aimed at advancing more powerful and efficient computing systems. The large foundation models that power generative AI, such as LLMs, are being integrated into various enterprise software tools and are also being employed for diverse purposes such as powering customer-facing chatbots, generating ad campaigns, accelerating drug discovery, and more. We expect this expansion to continue, pushing the boundaries of AI capabilities. Senior leaders’ awareness of gen AI innovation has increased interest, investment, and innovation in AI technologies, such as robotics, which is a new addition to our trends analysis this year. Advancements in AI are ushering in a new era of more capable robots, spurring greater innovation and a wider range of deployments.

Research methodology

To assess the development of each technology trend, our team collected data on five tangible measures of activity: search engine queries, news publications, patents, research publications, and investment. For each measure, we used a defined set of data sources to find occurrences of keywords associated with each of the 15 trends, screened those occurrences for valid mentions of activity, and indexed the resulting numbers of mentions on a 0–1 scoring scale that is relative to the trends studied. The innovation score combines the patents and research scores; the interest score combines the news and search scores. (While we recognize that an interest score can be inflated by deliberate efforts to stimulate news and search activity, we believe that each score fairly reflects the extent of discussion and debate about a given trend.) Investment measures the flows of funding from the capital markets into companies linked with the trend.

Data sources for the scores include the following:

- Patents. Data on patent filings are sourced from Google Patents, where the data highlight the number of granted patents.

- Research. Data on research publications are sourced from Lens.

- News. Data on news publications are sourced from Factiva.

- Searches. Data on search engine queries are sourced from Google Trends.

- Investment. Data on private-market and public-market capital raises (venture capital and corporate and strategic M&A, including joint ventures), private equity (including buyouts and private investment in public equity), and public investments (including IPOs) are sourced from PitchBook.

- Talent demand. Number of job postings is sourced from McKinsey’s proprietary Organizational Data Platform, which stores licensed, de-identified data on professional profiles and job postings. Data are drawn primarily from English-speaking countries.

In addition, we updated the selection and definition of trends from last year’s report to reflect the evolution of technology trends:

- The future of robotics trend was added since last year’s publication.

- Data sources and keywords were updated. For data on the future of space technologies investments, we used research from McKinsey’s Aerospace & Defense Practice.

Finally, we used survey data to calculate the enterprise-wide adoption scores for each trend:

- Survey scope. The survey included approximately 1,000 respondents from 50 countries.

- Geographical coverage. Survey representation was balanced across Africa, Asia, Europe, Latin America, the Middle East, and North America.

- Company size. Size categories, based on annual revenue, included small companies ($10 million to $50 million), medium-size companies ($50 million to $1 billion), and large companies (greater than $1 billion).

- Respondent profile. The survey was targeted to senior-level professionals knowledgeable in technology, who reported their perception of the extent to which their organizations were using the technologies.

- Survey method. The survey was conducted online to enhance reach and accessibility.

- Question types. The survey employed multiple-choice and open-ended questions for comprehensive insights.

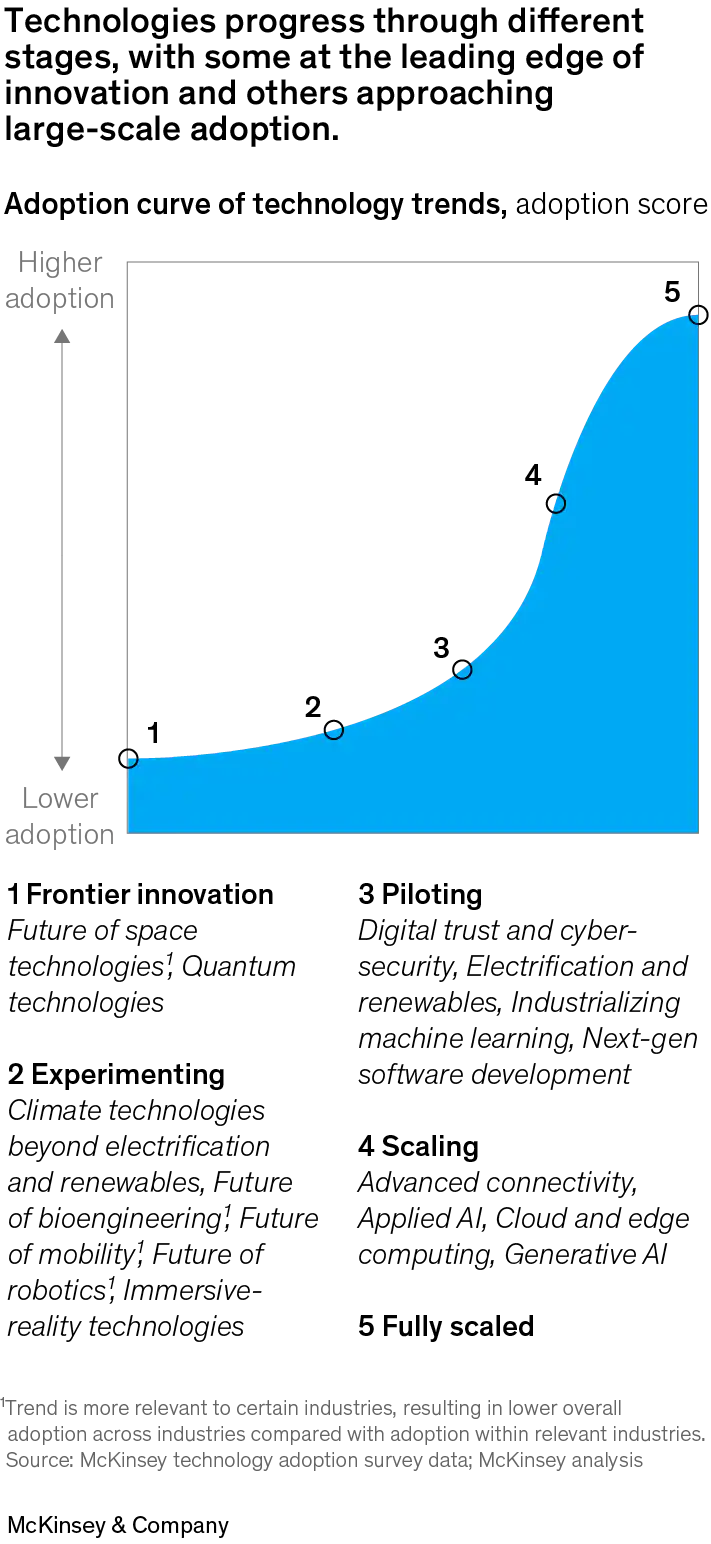

- Definition of enterprise-wide adoption scores:

- 1: Frontier innovation. This technology is still nascent, with few organizations investing in or applying it. It is largely untested and unproven in a business context.

- 2: Experimentation. Organizations are testing the functionality and viability of the technology with a small-scale prototype, typically done without a strong focus on a near-term ROI. Few companies are scaling or have fully scaled the technology.

- 3: Piloting. Organizations are implementing the technology for the first few business use cases. It may be used in pilot projects or limited deployments to test its feasibility and effectiveness.

- 4: Scaling. Organizations are in the process of scaling the deployment and adoption of the technology across the enterprise. The technology is being scaled by a significant number of companies.

- 5: Fully scaled. Organizations have fully deployed and integrated the technology across the enterprise. It has become the standard and is being used at a large scale as companies have recognized the value and benefits of the technology.

Electrification and renewables was the other trend that bucked the economic headwinds, posting the highest investment and interest scores among all the trends we evaluated. Job postings for this sector also showed a modest increase.

Although many trends faced declines in investment and hiring in 2023, the long-term outlook remains positive. This optimism is supported by the continued longer-term growth in job postings for the analyzed trends (up 8 percent from 2021 to 2023) and enterprises’ continued innovation and heightened interest in harnessing these technologies, particularly for future growth.

In 2023, technology equity investments fell by 30 to 40 percent to approximately $570 billion due to rising financing costs and a cautious near-term growth outlook, prompting investors to favor technologies with strong revenue and margin potential. This approach aligns with the strategic perspective leading companies are adopting, in which they recognize that fully adopting and scaling cutting-edge technologies is a long-term endeavor. This recognition is evident when companies diversify their investments across a portfolio of several technologies, selectively intensifying their focus on areas most likely to push technological boundaries forward. While many technologies have maintained cautious investment profiles over the past year, gen AI saw a sevenfold increase in investments, driven by substantial advancements in text, image, and video generation.

About QuantumBlack, AI by McKinsey

QuantumBlack, McKinsey’s AI arm, helps companies transform using the power of technology, technical expertise, and industry experts. With thousands of practitioners at QuantumBlack (data engineers, data scientists, product managers, designers, and software engineers) and McKinsey (industry and domain experts), we are working to solve the world’s most important AI challenges. QuantumBlack Labs is our center of technology development and client innovation, which has been driving cutting-edge advancements and developments in AI through locations across the globe.

Despite an overall downturn in private equity investment, the pace of innovation has not slowed. Innovation has accelerated in the three trends that are part of the “AI revolution” group: gen AI, applied AI, and industrializing machine learning. Gen AI creates new content from unstructured data (such as text and images), applied AI leverages machine learning models for analytical and predictive tasks, and industrializing machine learning accelerates and derisks the development of machine learning solutions. Applied AI and industrializing machine learning, boosted by the widening interest in gen AI, have seen the most significant uptick in innovation, reflected in the surge in publications and patents from 2022 to 2023. Meanwhile, electrification and renewable-energy technologies continue to capture high interest, reflected in news mentions and web searches. Their popularity is fueled by a surge in global renewable capacity, their crucial roles in global decarbonization efforts, and heightened energy security needs amid geopolitical tensions and energy crises.

The talent environment largely echoed the investment picture in tech trends in 2023. The technology sector faced significant layoffs, particularly among large technology companies, with job postings related to the tech trends we studied declining by 26 percent—a steeper drop than the 17 percent decrease in global job postings overall. The greater decline in demand for tech-trends-related talent may have been fueled by technology companies’ cost reduction efforts amid decreasing revenue growth projections. Despite this reduction, the trends with robust investment and innovation, such as gen AI, not only maintained but also increased their job postings, reflecting a strong demand for new and advanced skills. Electrification and renewables was the other trend that saw positive job growth, partially due to public sector support for infrastructure spending.

Even with the short-term vicissitudes in talent demand, our analysis of 4.3 million job postings across our 15 tech trends underscored a wide skills gap. Compared with the global average, fewer than half the number of potential candidates have the high-demand tech skills specified in job postings. Despite the year-on-year decreases for job postings in many trends from 2022 to 2023, the number of tech-related job postings in 2023 still represented an 8 percent increase from 2021, suggesting the potential for longer-term growth (Exhibit 1).

Enterprise technology adoption momentum

The trajectory of enterprise technology adoption is often described as an S-curve that traces the following pattern: technical innovation and exploration, experimenting with the technology, initial pilots in the business, scaling the impact throughout the business, and eventual fully scaled adoption (Exhibit 2). This pattern is evident in this year’s survey analysis of enterprise adoption conducted across our 15 technologies. Adoption levels vary across different industries and company sizes, as does the perceived progress toward adoption.

Image description:

A graph depicts the adoption curve of technology trends, scored from 1 to 5, where 1 represents frontier innovation, located at the bottom left corner of the curve; 2 is experimenting, located slightly above frontier innovation; 3 is piloting, which follows the upward trajectory of the curve; 4 is scaling, marked by a vertical ascent as adoption increases; and 5 is fully scaled, positioned at the top of the curve, indicating near-complete adoption.

In 2023, the trends are positioned along the adoption curve as follows: future of space technologies and quantum technologies are at the frontier innovation stage; climate technologies beyond electrification and renewables, future of bioengineering, future of mobility, future of robotics, and immersive-reality technologies are at the experimenting stage; digital trust and cybersecurity, electrification and renewables, industrializing machine learning, and next-gen software development are at the piloting stage; and advanced connectivity, applied AI, cloud and edge computing, and generative AI are at the scaling stage.

Footnote: Trend is more relevant to certain industries, resulting in lower overall adoption across industries compared with adoption within relevant industries.

Source: McKinsey technology adoption survey data

End of image description.

We see that the technologies in the S-curve’s early stages of innovation and experimenting are either on the leading edge of progress, such as quantum technologies and robotics, or are more relevant to a specific set of industries, such as bioengineering and space. Factors that could affect the adoption of these technologies include high costs, specialized applications, and balancing the breadth of technology investments against focusing on a select few that may offer substantial first-mover advantages.

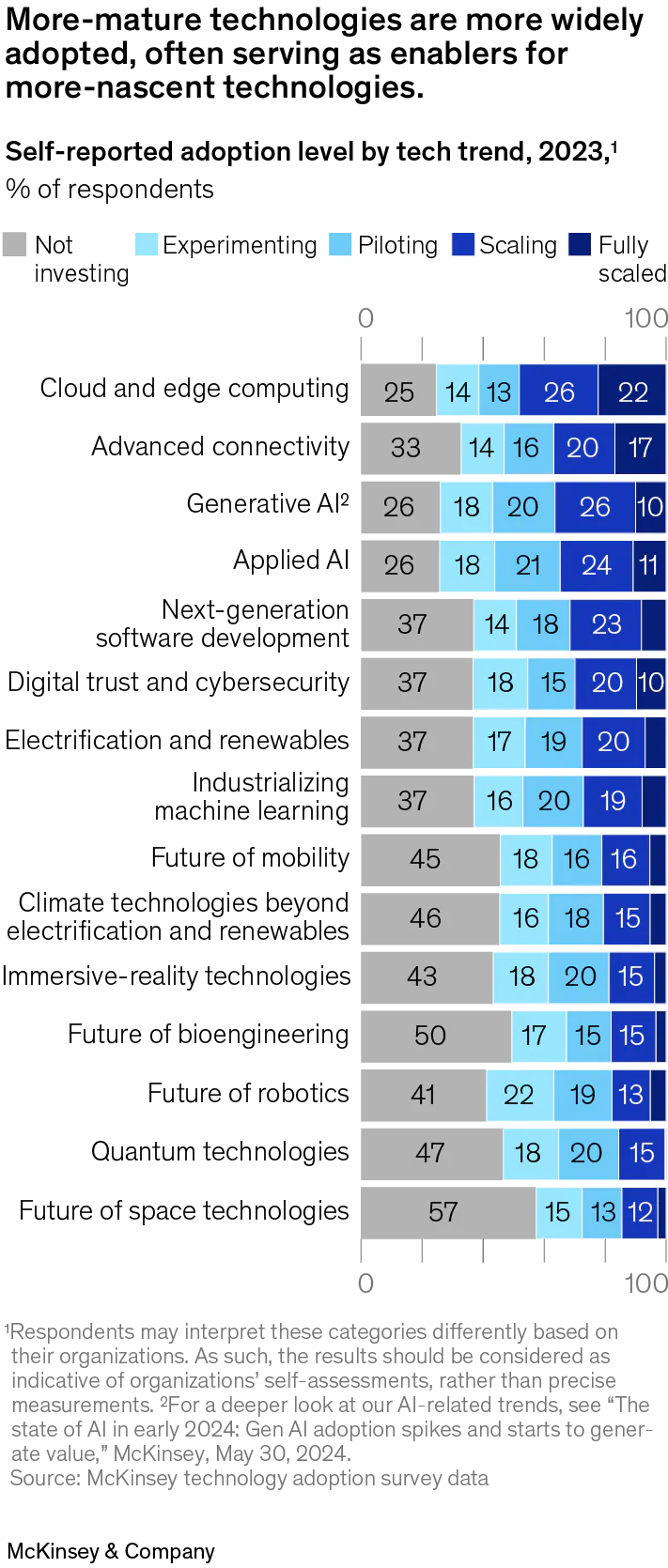

As technologies gain traction and move beyond experimenting, adoption rates start accelerating, and companies invest more in piloting and scaling. We see this shift in a number of trends, such as next-generation software development and electrification. Gen AI’s rapid advancement leads among trends analyzed, about a quarter of respondents self-reporting that they are scaling its use. More mature technologies, like cloud and edge computing and advanced connectivity, continued their rapid pace of adoption, serving as enablers for the adoption of other emerging technologies as well (Exhibit 3).

Image description:

A segmented bar graph shows the adoption levels of tech trends in 2023 as a percentage of respondents. The trends are divided into 5 segments, comprising 100%: fully scaled, scaling, piloting, experimenting, and not investing. The trends are arranged based on the combined percentage sum of fully scaled and scaling shares. Listed from highest to lowest, these combined percentages are as follows:

- cloud and edge computing at 48%

- advanced connectivity at 37%

- generative AI at 36%

- applied AI at 35%

- next-generation software development at 31%

- digital trust and cybersecurity at 30%

- electrification and renewables at 28%

- industrializing machine learning at 27%

- future of mobility at 21%

- climate technologies beyond electrification and renewables at 20%

- immersive-reality technologies at 19%

- future of bioengineering at 18%

- future of robotics at 18%

- quantum technologies at 15%

- future of space technologies at 15%

Source: McKinsey technology adoption survey data

End of image description.

The process of scaling technology adoption also requires a conducive external ecosystem where user trust and readiness, business model economics, regulatory environments, and talent availability play crucial roles. Since these ecosystem factors vary by geography and industry, we see different adoption scenarios playing out. For instance, while the leading banks in Latin America are on par with their North American counterparts in deploying gen AI use cases, the adoption of robotics in manufacturing sectors varies significantly due to differing labor costs affecting the business case for automation.

As executives navigate these complexities, they should align their long-term technology adoption strategies with both their internal capacities and the external ecosystem conditions to ensure the successful integration of new technologies into their business models. Executives should monitor ecosystem conditions that can affect their prioritized use cases to make decisions about the appropriate investment levels while navigating uncertainties and budgetary constraints on the way to full adoption (see the “Adoption developments across the globe” sections within each trend or particular use cases therein that executives should monitor). Across the board, leaders who take a long-term view—building up their talent, testing and learning where impact can be found, and reimagining the businesses for the future—can potentially break out ahead of the pack.

The 15 tech trends

Generative AI

In 2019, the interest score for Generative AI was 0.01 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.01 on the same scale.

The adoption rate was scored at 4. The investment in 2019 was 4 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 4 billion dollars. By 2023, the interest score for Generative AI was 0.64. The innovation score was 0.08. The investment was 36 billion dollars. Job postings within this trend changed by 111 percent from 2022 to 2023

5 = fully scaled)

Aerospace and defense, Agriculture, Automotive and assembly, Aviation, travel, and logistics, Business, legal, and professional services, Chemicals, Consumer packaged goods, Construction and building materials, Education, Electric power, natural gas, and utilities, Financial services, Healthcare systems and services, Information technology and electronics, Media and entertainment, Metals and mining, Oil and gas, Pharmaceuticals and medical products, Public and social sectors, Real estate, Retail, Semiconductors, Telecommunications,

Applied AI

In 2019, the interest score for Applied AI was 0.26 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.49 on the same scale.

The adoption rate was scored at 4. The investment in 2019 was 57 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 57 billion dollars. By 2023, the interest score for Applied AI was 0.5. The innovation score was 0.98. The investment was 86 billion dollars. Job postings within this trend changed by -29 percent from 2022 to 2023

5 = fully scaled)

Aerospace and defense, Agriculture, Automotive and assembly, Aviation, travel, and logistics, Business, legal, and professional services, Chemicals, Construction and building materials, Consumer packaged goods, Education, Electric power, natural gas, and utilities, Financial services, Healthcare systems and services, Information technology and electronics, Media and entertainment, Metals and mining, Oil and gas, Pharmaceuticals and medical products, Public and social sectors, Real estate, Retail, Semiconductors, Telecommunications,

Industrializing machine learning

In 2019, the interest score for Industrializing machine learning was 0.02 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.13 on the same scale.

The adoption rate was scored at 3. The investment in 2019 was 37 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 37 billion dollars. By 2023, the interest score for Industrializing machine learning was 0.04. The innovation score was 0.31. The investment was 3 billion dollars. Job postings within this trend changed by -36 percent from 2022 to 2023

5 = fully scaled)

Aerospace and defense, Agriculture, Automotive and assembly, Aviation, travel, and logistics, Business, legal, and professional services, Chemicals, Consumer packaged goods, Education, Electric power, natural gas, and utilities, Financial services, Healthcare systems and services, Information technology and electronics, Media and entertainment, Metals and mining, Oil and gas, Pharmaceuticals and medical products, Public and social sectors, Real estate, Retail, Semiconductors, Telecommunications,

Next-generation software development

In 2019, the interest score for Next-generation software development was 0.03 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.14 on the same scale.

The adoption rate was scored at 3. The investment in 2019 was 54 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 54 billion dollars. By 2023, the interest score for Next-generation software development was 0.03. The innovation score was 0.2. The investment was 17 billion dollars. Job postings within this trend changed by -37 percent from 2022 to 2023

5 = fully scaled)

Advanced industries, Business, legal, and professional services, Consumer packaged goods, Financial services, Healthcare systems and services, Information technology and electronics, Manufacturing, Media and entertainment, Telecommunications,

Digital trust and cybersecurity

In 2019, the interest score for Digital trust and cybersecurity was 0.18 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.11 on the same scale.

The adoption rate was scored at 3. The investment in 2019 was 25 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 25 billion dollars. By 2023, the interest score for Digital trust and cybersecurity was 0.41. The innovation score was 0.18. The investment was 34 billion dollars. Job postings within this trend changed by -34 percent from 2022 to 2023

5 = fully scaled)

Aerospace and defense, Aviation, travel, and logistics, Consumer packaged goods, Education, Electric power, natural gas, and utilities, Financial services, Healthcare systems and services, Information technology and electronics, Media and entertainment, Pharmaceutical and medical products, Public and social sectors, Retail, Telecommunications,

Advanced connectivity

In 2019, the interest score for Advanced connectivity was 0.17 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.49 on the same scale.

The adoption rate was scored at 4. The investment in 2019 was 37 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 37 billion dollars. By 2023, the interest score for Advanced connectivity was 0.23. The innovation score was 0.63. The investment was 29 billion dollars. Job postings within this trend changed by -24 percent from 2022 to 2023

5 = fully scaled)

Aerospace and defense, Agriculture, Automotive and assembly, Aviation, travel, and logistics, Construction and building materials, Electric power, natural gas, and utilities, Financial services, Healthcare systems and services, Information technology and electronics, Media and entertainment, Manufacturing, Metals and mining, Oil and gas, Retail, Telecommunications,

Immersive-reality technologies

In 2019, the interest score for Immersive-reality technologies was 0.09 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.15 on the same scale.

The adoption rate was scored at 2. The investment in 2019 was 5 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 5 billion dollars. By 2023, the interest score for Immersive-reality technologies was 0.12. The innovation score was 0.24. The investment was 6 billion dollars. Job postings within this trend changed by -36 percent from 2022 to 2023

5 = fully scaled)

Aerospace and defense, Automotive and assembly, Aviation, travel, and logistics, Construction and building materials, Consumer packaged goods, Education, Electric power, natural gas, and utilities, Financial services, Healthcare systems and services, Information technology and electronics, Media and entertainment, Real estate, Retail,

Cloud and edge computing

In 2019, the interest score for Cloud and edge computing was 0.04 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.14 on the same scale.

The adoption rate was scored at 4. The investment in 2019 was 50 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 50 billion dollars. By 2023, the interest score for Cloud and edge computing was 0.05. The innovation score was 0.2. The investment was 54 billion dollars. Job postings within this trend changed by -38 percent from 2022 to 2023

5 = fully scaled)

Aerospace and defense, Automotive and assembly, Aviation, travel, and logistics, Business, legal, and professional services, Chemicals, Electric power, natural gas, and utilities, Financial services, Healthcare systems and services, Information technology and electronics, Manufacturing, Media and entertainment, Pharmaceuticals and medical products, Retail, Semiconductors, Telecommunications,

Quantum technologies

In 2019, the interest score for Quantum technologies was 0.01 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.02 on the same scale.

The adoption rate was scored at 1. The investment in 2019 was 0 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 0 billion dollars. By 2023, the interest score for Quantum technologies was 0.02. The innovation score was 0.04. The investment was 1 billion dollars. Job postings within this trend changed by -17 percent from 2022 to 2023

5 = fully scaled)

Aerospace and defense, Automotive and assembly, Aviation, travel, and logistics, Chemicals, Financial services, Information technology and electronics, Pharmaceuticals and medical products, Telecommunications,

Future of robotics

In 2019, the interest score for Future of robotics was 0.01 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.03 on the same scale.

The adoption rate was scored at 2. The investment in 2019 was 3 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 3 billion dollars. By 2023, the interest score for Future of robotics was 0.01. The innovation score was 0.05. The investment was 6 billion dollars. Job postings within this trend changed by -20 percent from 2022 to 2023

5 = fully scaled)

Agriculture, Automotive and assembly, Chemicals, Consumer packaged goods, Information technology and electronics, Manufacturing, Metals and mining, Oil and gas, Pharmaceutical and medical products, Retail, Semiconductors, Telecommunications,

Future of mobility

In 2019, the interest score for Future of mobility was 0.29 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.19 on the same scale.

The adoption rate was scored at 2. The investment in 2019 was 151 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 151 billion dollars. By 2023, the interest score for Future of mobility was 0.49. The innovation score was 0.33. The investment was 83 billion dollars. Job postings within this trend changed by -5 percent from 2022 to 2023

5 = fully scaled)

Automotive and assembly, Aviation, travel, and logistics, Electric power, natural gas, and utilities, Financial services, Metals and mining, Oil and gas, Public and social sectors, Retail,

Future of bioengineering

In 2019, the interest score for Future of bioengineering was 0.13 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.39 on the same scale.

The adoption rate was scored at 2. The investment in 2019 was 97 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 97 billion dollars. By 2023, the interest score for Future of bioengineering was 0.14. The innovation score was 0.52. The investment was 62 billion dollars. Job postings within this trend changed by -23 percent from 2022 to 2023

5 = fully scaled)

Agriculture, Chemicals, Consumer packaged goods, Healthcare systems and services, Pharmaceuticals and medical products,

Future of space technologies

In 2019, the interest score for Future of space technologies was 0.12 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.07 on the same scale.

The adoption rate was scored at 1. The investment in 2019 was 5 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 5 billion dollars. By 2023, the interest score for Future of space technologies was 0.17. The innovation score was 0.09. The investment was 9 billion dollars. Job postings within this trend changed by -9 percent from 2022 to 2023

5 = fully scaled)

Aerospace and defense, Agriculture, Aviation, travel, and logistics, Telecommunications,

Electrification and renewables

In 2019, the interest score for Electrification and renewables was 0.52 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.29 on the same scale.

The adoption rate was scored at 3. The investment in 2019 was 160 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 160 billion dollars. By 2023, the interest score for Electrification and renewables was 0.73. The innovation score was 0.36. The investment was 183 billion dollars. Job postings within this trend changed by 1 percent from 2022 to 2023

5 = fully scaled)

Agriculture, Automotive and assembly, Aviation, travel, and logistics, Chemicals, Construction and building materials, Electric power, natural gas, and utilities, Metals and mining, Oil and gas, Real estate,

Climate technologies beyond electrification and renewables

In 2019, the interest score for Climate technologies beyond electrification and renewables was 0.2 on a scale from 0 to 1, where 0 is low and 1 is high. The innovation score was 0.15 on the same scale.

The adoption rate was scored at 2. The investment in 2019 was 51 on a scale from 1 to 5, with 1 defined as “frontier innovation” and 5 defined as “fully scaled.” The investment was 51 billion dollars. By 2023, the interest score for Climate technologies beyond electrification and renewables was 0.25. The innovation score was 0.2. The investment was 68 billion dollars. Job postings within this trend changed by -11 percent from 2022 to 2023

5 = fully scaled)

Agriculture, Automotive and assembly, Aviation, travel, and logistics, Chemicals, Construction and building materials, Electric power, natural gas, and utilities, Metals and mining, Oil and gas, Real estate,

electrification and renewables