Your next car, should it be electric, may be powered by an unlikely element: Iron. Lithium Iron Phosphate batteries (LFPs) have a bizarre and winding history, but now appear poised to dominate a significant portion of our energy mix. LFP batteries offer consumers a safer, cheaper, and (possibly) overall better alternative to other battery chemistries. They have the potential to form a crucial part of a more sustainable energy future.

How Lithium Batteries Work

It’s important to understand that so-called “Lithium Ion” batteries are not one specific type of battery. The term instead refers to a family of energy storage devices based on Lithium. Lithium is the element of choice for two reasons. First, as one can see on the periodic table of elements (above), Lithium is the third lightest known element, with just three protons, three neutrons, and three electrons. When it comes to electric vehicles (EVs), weight is obviously of paramount importance. Second, Lithium, unlike many elements, is also able to share electrons freely; it is these electrons that provide energy.

During discharge, Lithium Ions stored in the anode are freed from their electrons and flow through an electrolyte/separator toward the cathode. The now free electrons pass through the “anode” into the vehicle or device, powering it, then back to the battery, attracted to the now positively-charged cathode. During charging, the reverse happens, Lithium Ions are released by the cathode to be received by the anode.

There are three primary form factors for batteries: pouches (used by companies like Nissan and Renault), prismatic (popular in many Chinese-designed EVs), and cylindrical (traditionally favored by Tesla and many consumer products.) Aside from form factor, while anodes are generally made of graphite, there are a variety of cathode chemistries on the market. Three dominate in today’s EV sector: lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminum oxide (NCA), and lithium iron phosphate (LFP).

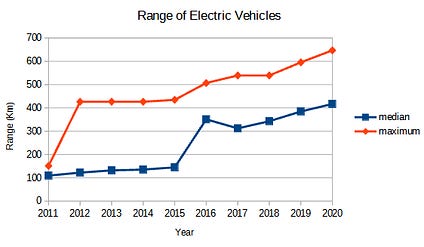

Since their introduction in the early 1990s, Lithium batteries have seen a steady 3–5% annual increase in both specific energy (Wh/kg) and energy density (Wh/L), with the best batteries now reaching a gravimetric specific energy of 300 Wh/kg. This has made mobile electronic devices like cell phones and laptops, thinner and lighter.

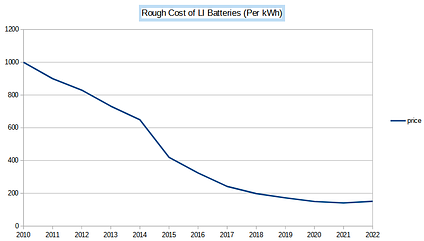

In addition, the cost per unit of energy stored, which is measured in kilowatt-hours, has steadily fallen from over $1000/kWh to around $150/kWh today. Note the small uptick in prices in 2022, we will revisit this in a moment. In sum, Lithium batteries are steadily getting smaller, lighter, and cheaper for the same energy capacity. These innovations have steadily laid the groundwork for affordable and practical electric vehicles and energy storage devices.

My mission is to educate and inspire concepts that promote a better future. All articles are free and written in my spare time. Please consider supporting my work by becoming a paid subscriber.

The Iron Battery

This article focuses on Lithium Iron Phosphate, or LFP, cathode chemistry. LFPs have a somewhat convoluted history. They can trace their roots to research done in the mid-1990s. Indeed, while there are dozens of patents governing LFP technology, three stand out. The first was filed in 1997 by John Goodenough. This patent described the performance of the LFP cathode material and can be considered the invention of the technology. The problem, however, was the LFP had extremely poor conductivity that made it ill-suited for batteries.

The second patent, filed in 2001 and granted to the University of Montreal, solved the low conductivity problem with a specialized carbon coating. The third patent, from Hydro Quebec, brought together the two prior patents and described how to efficiently produce this carbon coating material. Because of the interlocking nature of these patents, they were bound together to create a licensing consortium known as ‘‘LiFePO4+C AG” in 2011.

To some extent, as is often the case with patents, the cost of licensing the technology inhibited further development. See my article on the problems with patents here. As a consequence, innovation and production of Lithium batteries for EVs focused on NCA and NMC chemistries. That is, everywhere except one country: China.

It is here that the story gets interesting. For reasons that are not publicly known, the LiFePO4+C AG consortium elected not to enforce its patent in China. It is speculated that perhaps because John Goodenough’s original 1997 patent was not filed there, LiFePO4+C AG felt that they would be unlikely to successfully defend their patent bundle in the Middle Kingdom. Instead what ensued resembled an out-of-court settlement: Chinese producers may produce LFPs without paying any licensing fees, but they cannot export those products to other markets.

LFPs aside, China went all-in on Lithium-ion technology in the 2000s, pumping government subsidies into the nascent industry. As a consequence, China dominates Lithium-ion battery production at almost every level. Over half of the raw material processing of lithium, cobalt, and graphite occurs in China. China dominates the lithium battery supply chain, producing 97 percent of battery cells, and some 70 percent of cathode and 85% of anode materials globally. But free from LFP licensing fees, China disproportionately dominated this chemistry, producing some 90 percent of the world’s LFP powder.

A Superior Chemistry?

Just as with fossil fuels, the optimal battery chemistry and form factor are largely dictated by the intended end use. In high-performance vehicles, such as those marketed by Tesla prior to 2017, LFPs were not the best choice. LFPs lack the energy density of Nickel/Cobalt formulations and raw “power.” LFPs were heavier and reduced vehicle range and performance.

But as the EV market now shifts from luxury niche products to everyday vehicles, the strengths of LFPs have quickly become apparent. These vehicles carry slimmer profit margins, which works to LFP’s advantage. LFPs cost less than NCA and NMC because they do not require Nickel or Cobalt, commodities that are subject to wild supply chain distortions (see the uptick in battery prices in 2022 as a result of Russia’s war in Ukraine). Instead, they rely on iron, a cheap and abundant element. The savings are significant; LFPs cost about 20-30 percent less.

LFPs are also safer. While it’s important to remember that EVs are already less likely to catch fire than traditional ICE vehicles, LFPs are inherently less prone to thermal runaway (catching fire). The flashpoint, or the point at which material will catch fire, for NMC is 419 F, while as high as 518 degrees for LFP. China’s BYD Blade battery has taken this a step further by elongating the cell and increasing the surface area, transforming the entire cell into a giant heat sink. In the event of a puncture or damage, it is nearly impossible for the cell to catch fire.

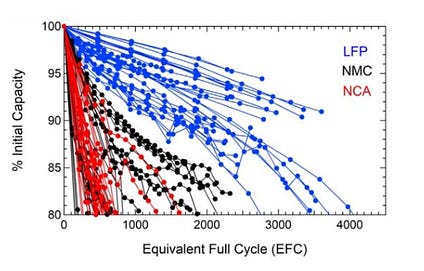

LFP batteries have another distinct advantage: longevity. While other battery chemistries have now proven they can last hundreds of thousands of miles, LFPs last longer still. According to a study from the Journal of the Electrochemical Society, LFPs will typically retain over 80 percent of their capability over 3000 charging/discharging cycles. Across all conditions tested, LFPs demonstrated the highest cycle lifetimes. This means a typical EV battery pack is likely to outlive the vehicle itself and possibly be usable over a million miles later.

This superior longevity means greater simplicity for the consumer. Charging one’s EV to 100 percent, for example, is generally frowned upon for vehicles using NCA and NMC chemistries because it will shorten the life of the battery. With these chemistries, a 100 percent charge is only recommended for the occasional long trip when the extra range is needed. So while NCA and NMC offer a greater potential range, the recommended daily usable range is 20 percent lower.

Oddly enough, this 20 percent roughly matches the energy density deficit of LFPs, and since LFP batteries are much happier to be charged to 100 percent capacity, their usable daily range roughly matches their more expensive NCA and NMC counterparts.

Why Now?

Tesla began using LFPs in American-made standard-range vehicles in 2021. Ford, Volkswagen, Rivian, and others are not far behind. Tesla expects that soon, LFPs will account for 2/3rd of their vehicle sales. BloombergNEF notes that while there were no US cars powered by LFP in 2020, it expects that by the end of the decade, some 40% of EVs will utilize this chemistry.

This begs the question, with all of their advantages, why have LFPs failed to catch on outside of China, at least until now? Two developments are leading the change. First, the last of the LiFePO4+C AG patents expired in 2022. Now, for the first time, battery manufacturers will be able to take full advantage of the cost savings that LFPs offer.

Second, the energy density issues that limited range have been mitigated. Traditionally, battery cells are grouped into modules, which are then stacked together into a battery pack, which is then inserted into the floor of the car. New Cell-To-Pack (CTP) technology eschews the module casings entirely and inserts the cells directly into the battery pack. First pioneered by China’s battery giant CATL in 2019, this is quickly becoming standard across the industry, improving volume utilization and reducing weight by over 15 percent.

Initially, the shift toward LFPs will work to the benefit of Chinese battery giants like CATL and BYD, who have a significant head start in the technology and production scale required. Also, now freed from the LiFePO4+C AG agreement, they can export their products abroad. But in 2022, the US Congress passed the so-called “Inflation Reduction Act,” which contained provisions that will provide some $142 Billion to produce battery components and materials domestically.

Conclusion

Humanity has been gradually decarbonizing its primary energy sources for five centuries. With each energy revolution, from wood, to coal, to oil, to natural gas, pollutants and carbon emissions fell per unit of energy output. LFPs offer a compelling alternative to gasoline-powered vehicles and trucks, as well as an affordable storage medium for wind and solar energy at times when the wind isn’t blowing or the Sun isn’t shining.

Progress and growth, as I discussed here, are good for the environment. Steady improvements in battery technology, alongside proper policy design, can accelerate the transition to a more sustainable future.