Intent Matters in Product Development – by Alex Johnson

My favorite fintech product of all time was a mobile wallet, launched by Square in 2011. Originally called Card Case (and later Square Wallet), the app created a startlingly seamless and enjoyable mobile payments experience.

Here’s how it worked:

-

A consumer downloaded the Card Case app to their smartphone and was able to see a map of all the nearby merchants that were using Square’s POS Register.

-

In the app, the consumer was able to look up information on these merchants (operating hours, menus, special offers, etc.) and choose to ‘open a tab’ at any merchant that they wanted to shop with.

-

When the consumer visited a merchant that they had an open tab with, the merchant’s Square POS Register would automatically detect their smartphone (using geofencing) and would pop up the consumer’s name and face on the screen.

-

When the consumer was ready to make a purchase, all they had to do was give the cashier their name to complete the transaction.

-

In the background, Square would charge the card on file, send the consumer a digital receipt, and give them the option of adding a tip.

It’s the only payment product that I’ve ever used that was, legitimately, a 10x improvement on the experience of using a credit card or debit card. Apple Pay, Google Pay, Toast Order & Pay … none of them come close.

It’s also one of the few fintech products to ever permanently lodge itself in my brain. I honestly miss it … and apparently I’m not the only one, as I discovered on Twitter recently.

So, what happened?

In short, the product never took off. Despite the quality of the payment experience itself, Square wasn’t able to drive enough adoption on the merchant side to make the product truly useful:

Anytime you opened Square Wallet, the app would show the shops nearest to you that would take it as a form of payment. Even in San Francisco’s South of Market neighborhood, the epicenter of the city’s startup scene — the place where Twitter itself was invented — you would never see more than a smattering of shops that would take it, and the choices were always random. All too often, they weren’t the places you really wanted to go.

Without that ubiquity, Square Wallet was never able to rise above novelty.

The company killed the product in 2014.

In explaining that decision years later, Square’s CFO would say:

I think what we learned there and why we shut it down is if you tried to contain what a consumer wants to do, you effectively are removing utility from them.

Intent Matters

There are two basic ways to approach product development. There’s the strategist’s way and the idealist’s way.

The strategist’s way starts with constraints — price, competition, margin, etc. — and works backwards. The idealist’s way starts with a (perhaps unrealistic) vision of the future — of what the customer would ideally want — and works forwards.

These two schools of thought (and the inherent conflicts between them) are best illustrated by the development of the original Macintosh computer, which was initially conceived of as a low cost, mainstream personal computer by Jef Raskin, an early Apple employee. Raskin was a product strategist through and through, while his coworker Steve Jobs was the prototypical product idealist. They did not, as you might have guessed, get along well:

Jobs was enthralled by Raskin’s vision, but not by his willingness to make compromises to keep down the cost. At one point in the fall of 1979 Jobs told him instead to focus on building what he repeatedly called an “insanely great” product. “Don’t worry about price, just specify the computer’s abilities,” Jobs told him. Raskin responded with a sarcastic memo. It spelled out everything you would want in the proposed computer: a high-resolution color display, a printer that worked without a ribbon and “could produce graphics in color at a page per second, unlimited access to the ARPA net, and the capability to recognize speech and synthesize music, “even simulate Caruso singing with the Mormon tabernacle choir, with variable reverberation.” The memo concluded, “Starting with the abilities desired is nonsense. We must start both with a price goal, and a set of abilities, and keep an eye on today’s and the immediate future’s technology.”

The conflict between Raskin and Jobs ended with Jobs replacing Raskin as the head of the Mac team and quickly (and, in his typical management style, brutally) remolding the team around his singular obsession to build an “insanely great” computer:

The result was that the Macintosh team came to share Jobs’s passion for making a great product, not just a profitable one. “Jobs thought of himself as an artist, and he encouraged the design team to think of ourselves that way too,” said Hertzfeld. “The goal was never to beat the competition, or to make a lot of money. It was to do the greatest thing possible, or even a little greater.” He once took the team to see an exhibit of Tiffany glass in San Francisco because he believed they could learn from Louis Tiffany’s example of creating great art that could be mass-produced. Recalled Bud Tribble, “We said to ourselves, ‘Hey, if we’re going to make things in our lives, we might as well make them beautiful.’ ”

This, in my opinion, is the root of Apple’s success as a product-led company. Steve Jobs understood, perhaps only at an instinctive level, the need to prevent commercial objectives (make money, beat competitors, etc.) from infecting the process of designing and building Apple’s products.

In short, he understood that intent matters in product development.

This is what Square screwed up back in 2011 with Card Case. The company’s primary intent was strategic (build a closed-loop payments network connecting consumers directly with Square’s merchants) and that intent imposed constraints on the design and development of the product (it only worked at Square merchants), which ultimately proved to be its undoing.

I see this mistake happen a lot in fintech, probably because fintech companies ship products so often that they have more opportunities to fall into this trap. That said, banks and merchants aren’t immune to making this mistake and I think examples of each are instructive.

Merchants: CurrentC

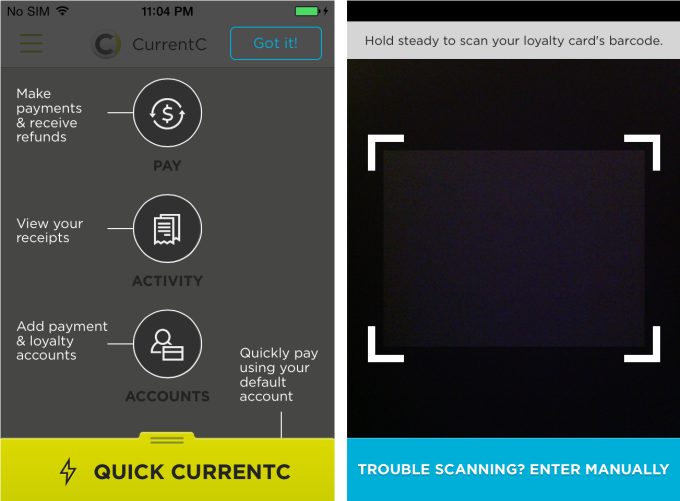

CurrentC was a mobile payments app developed by the Merchant Customer Exchange (MCX), a group of large merchants that included Walmart, Target, Best Buy, CVS, Shell Oil, Lowes, Michaels, Publix Super Markets and Sears.

The app was, in many ways, ahead of its time:

-

It allowed merchants to present offers and coupons at the beginning of the shopping process, in a similar way to what BNPL providers are beginning to do.

-

It facilitated payment transactions via QR codes, which has become a much more popular way to pay in the U.S. since the beginning of the COVID-19 pandemic.

-

It utilized the ACH rails to process payments rather than the card networks, in the same way that Plaid is now enabling with its account-to-account payments functionality.

And yet, CurrentC failed, in a highly public and rather spectacular fashion. The development of the app was besieged by delays, as each MCX retailer attempted to add in its own proprietary features. Retailers angered customers by disabling other mobile payment options in order to promote CurrentC. And the experience of actually using the app was, for the brief time it was available to the public, clunky and unintuitive.

Why?

Once again, it comes back to intent. The purpose behind the development of CurrentC (and the creation of MCX, more broadly) wasn’t to build a better payments experience for consumers. It was to reduce the payment processing costs that merchants were paying to banks and the card networks. How do I know this? Because Lee Scott, the former CEO of Walmart said so when asked if he thought MCX would succeed:

I don’t know that it will, and I don’t care. As long as Visa suffers.

Ironic, isn’t it?

Walmart and MCX wanted to cut their payment processing costs and make the card networks suffer, but by letting that intent drive the development of CurrentC all they did was ensure that they would be the ones that suffered.

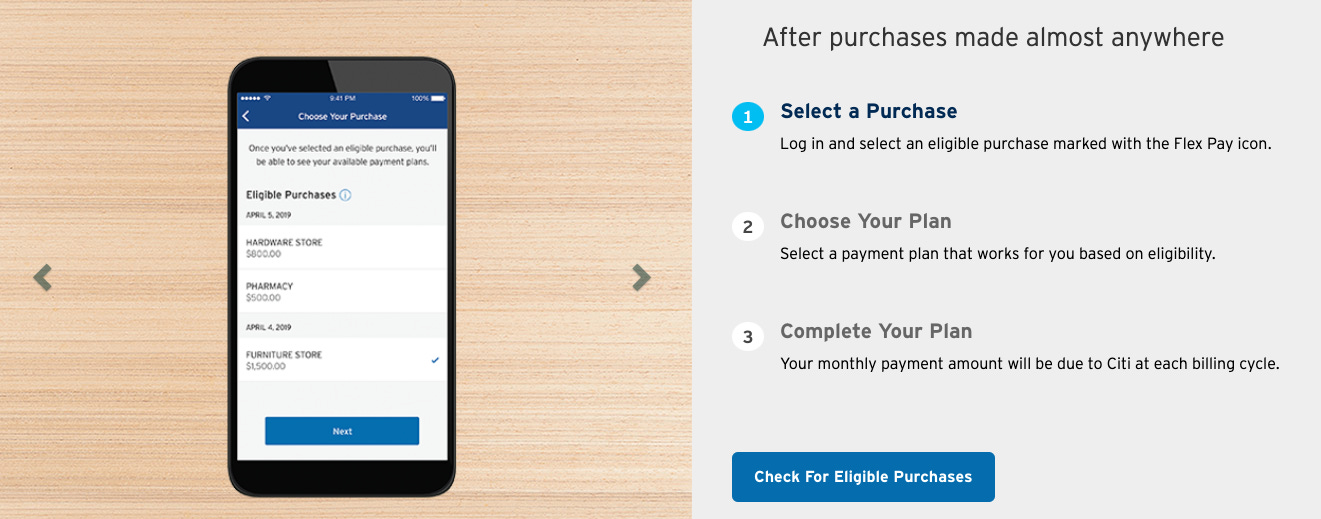

Banks: Retroactive BNPL

Consumers like BNPL because it enables them to buy stuff that they can’t quite afford without interest or fees (for the most part) and because it is conveniently integrated into the point-of-sale experience.

So, if you are a bank with a large credit card portfolio and you are worried about the $8 billion to $10 billion in annual revenues being siphoned away by BNPL, do you:

A.) Build a competitive, low-cost BNPL product that is similarly well integrated into merchants’ checkout pages and POS terminals?

or

B.) Add the ability for existing cardholders to retroactively convert purchases over a certain size into installment payments that come with interest and/or fees?

A product idealist would hone in on the first part — consumers like BNPL because — and would work forwards from there. They might not build an exact replica of Affirm or Klarna; they might build a fundamentally different product that addresses the gaps in BNPL, but the product that they built would be focused on their customers’ problems.

A product strategist, on the other hand, would focus on the second part — worried about the $8 billion to $10 billion in annual revenues — and work backwards from there. They would design a product that protected the company’s existing revenue streams first and then tried to deliver some value to customers second.

You can guess where I’m going with this.

American Express Pay It Plan It, Citi Flex Pay, and Chase My Plan are all wonderful examples of the latter approach to product development. And much like MCX and CurrentC, these products have failed to achieve their strategic goal (fending off the threat of BNPL) precisely because that goal constrained the development of those products in the first place.

Cultivating Product Idealism

This is a hard problem to solve.

It’s not a problem that you can throw more money or bodies at — MCX had plenty of both. Nor is it a problem that clever product managers can design their way out of — Square built the absolute best mobile payments experience with Card Case and still failed.

The problem is nuanced. It’s about incentives, both obvious and subtle. It’s about the composition and culture of teams. It’s about taking your time and making mistakes and indulging in your more artistic impulses.

Apple solved this problem by allowing Steve Jobs to blast around its hallways, whisk his team away on field trips to look at Tiffany lamps, and hire people in unusual ways:

Jobs’s primary test for recruiting people in the spring of 1981 to be part of his merry band of pirates was making sure they had a passion for the product. He would sometimes bring candidates into a room where a prototype of the Mac was covered by a cloth, dramatically unveil it, and watch. “If their eyes lit up, if they went right for the mouse and started pointing and clicking, Steve would smile and hire them,” recalled Andrea Cunningham.

This isn’t a replicable solution.

A more useful example to study is our old friend Square, which didn’t abandon its goal to build a consumer payments app and create a closed loop network, but did take a very different approach to pursuing that goal the second time around.

I think the development and growth of Cash App provides a few important lessons:

-

Simple, grassroots origin. Cash App was created in 2013 (interestingly, a year before Square Wallet was killed). It wasn’t part of some grand strategic vision and it wasn’t (at the time) an especially big or sophisticated product. It was created during a company hackathon for the purpose of helping consumers easily send money to each other.

-

Lesson: The easiest way to spark idealistic product development is to let talented people mess around in their spare time. If you start out, on day one, trying to play 3-D chess, things quickly get complicated.

-

-

Resources and autonomy. For the first 5+ years of Cash App’s existence, Square did a remarkable job of funding new product features, both obvious (debit card) and unusual (Bitcoin in 2017?), with very little corporate interference.

-

Lesson: Nurturing promising new products and helping them grow is a delicate proposition. It’s a bit like building a fire. You want to slowly feed it resources without smothering it or overwhelming it with more than it needs.

-

-

Creative control. One of Cash App’s most unique and valuable attributes is its brand. Starting with #CashAppFriday social media campaigns in 2017 and expanding into everything from a truly wild apparel line to hip-hop, Cash App has carefully cultivated a brand that isn’t like anything else in financial services.

-

Lesson: The hardest thing for corporations to relinquish control over is brand. Trust me. Early on, I bet Jack Dorsey had to tie Square’s Chief Marketing Officer to their chair to stop them from getting involved in Cash App’s brand. Good thing he did though. Product idealists can only do what they do best if you trust them to get weird.

-

-

Patient corporate strategy. The single most impressive thing, to me, about Square’s stewardship of Cash App has been the incredible patience and restraint that it has shown in merging it with its merchant ecosystem. It really wasn’t until the last year or two that it has started to build bridges between the two product sets. Obviously, the Afterpay acquisition and enabling Square sellers to accept Cash App as a form of payment will accelerate things on this front, but Square has clearly been playing the long game.

-

Lesson: Corporate strategy has an important role to play in product development. Every company rightly wants to build a flywheel that drives a sustainable competitive advantage for them in the market. The trick, though, is not rushing assembly of that flywheel.

-

Sponsored Content

Need to meet new partners & customers in 2022? Fintech Meetup has you covered! Taking place online, March 22-24, we use proprietary tech to facilitate 30,000+ meetings for 3,000+ participants from fintechs (including Akoya, Array, Clair, MANTL, Nium, Ripple and hundreds more!), investors (including Bain Capital, General Atlantic & Mosaik Partners), banks (including Bank of America, Citi, JP Morgan & Wells Fargo), tech cos, credit unions, networks, media and more! Learn More & Get Ticket

Dumb Advice for Banks

This is going to be a recurring feature in this newsletter, inspired by Matt Levine, who wrote recently:

Say words about crypto. Say words about electric cars. Tweet a picture of a dog. Your stock will go up. Your shareholders will be rich and happy. You can raise lots of money to finance normal good businessy things, because your stock is at an all-time high, because you got in a fight with Elon Musk on Twitter or changed your avatar to a Bored Ape or whatever. Lower your cost of capital. Embrace the stupidity.

Banks, of course, are going to be some of the last companies on Earth to join in the trend of saying or doing nonsense things about crypto or other meme-adjacent topics in order to pump up their stock prices. Banks are too conservative and, more to the point, their earnings are doing just fine these days. They don’t need memes the way AMC does.

But that shouldn’t stop us from having fun! So, periodically, I’m going to offer some truly dumb advice for how banks can improve their share price by doing dumb, meme-type things (NOTE — THIS ISN’T INVESTMENT ADVICE!).

Idea #1 — Sell the first digital bank branch NFT.

OK, I think this one is actually pretty good!

You take a branch that you are already planning to sell, you snap a picture of it, you raze the building to the ground, you sell the land to someone and make money, you mint an NFT of the image and sell it as the first digital bank branch (this is the destroy-an-actual-diamond-to-move-the-value-to-a-digital-diamond asset transference hypothesis) and make more money, then brag on Reddit and Twitter and elsewhere about having destroyed a branch to mint an NFT and make even more money as your stock go up … I guess? I don’t know.

Got other dumb, meme-inspired ideas for banks? Send them my way!

Get Fancy, Fintech

Everything is fintech, including (I’m delighted to discover) black tie charity galas in New York City. I’m not able to attend this year (throw next year’s party in Montana, Nik! We’re fancy out here!) but you certainly should. RSVP here.

Alex Johnson is a Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies.

Twitter: @AlexH_Johnson

LinkedIn: Linkedin.com/in/alexhjohnson/