Being an Amazon Seller in 2020; Year in Review — Molson Hart

I’m the founder and CEO of Viahart, an educational toy company. We did about $7.4 million in sales in 2020, mostly through e-commerce channels like Amazon and Walmart.com. This article is going to tell you what that was like and how things were different in 2020 than in 2019.

To give you some context, let me tell you a bit about our business. We design building toys, plush animals, and active play toys. We manufacture them in Cambodia, Vietnam, China, and the USA (not as much as we’d like), and then we sell them mainly online. We operate our own warehouse in Texas, and we also use Amazon’s network of fulfillment centers to get you our products.

Marketplace Breakdown of Sales in 2020

Our website (green) was 1.3%

The main takeaway here is that Amazon accounted for 93.4% of our sales in 2020. For companies which sell on Amazon, this fairly typical. Two years ago, it was 98.1%. It’s risky to have so much of your sales concentrated in a single platform, but we’ve at least made progress. As explained here, it’s really challenging for companies like our own to not be dependent on Amazon for revenue.

Amazon is the most expensive e-commerce platform to sell on.

The desire to get more sales off-Amazon doesn’t just come from the risk that they suspend our company from their platform. It’s also about the cost of selling there relative to other channels. If we sell $100 worth of product on our Amazon store, on average, we get $48.25 back. At our Walmart.com store, we get $54.50 and on eBay store, we get $57.50 back. On our website (which could use a bath!), by virtue of not having a commission and by having much lower per unit shipping costs driven by larger orders (the more you ship, the cheaper it is to ship per unit), we get $83.10 back!

What’s driving those cost differences between the big marketplaces Amazon, eBay, and Walmart? It’s not shipping. It costs us roughly the same to ship out of our warehouse as it does for us to use Amazon’s FBA. eBay’s has slightly lower commissions, but the main reasons for the cost differences between these marketplaces are:

-

Refunds – It could be Amazon’s customer service or perhaps the customers themselves, but Amazon grants more refunds (2.6% of revenue) than either Walmart (1.9%) or famously seller friendly eBay (1%)

-

Storage – It costs a lot of money to store your products in Amazon’s fulfillment centers. We spent 2.4% of our Amazon revenue on storage. Amazon’s service was very spotty this year, but being able to reach 99.99% of America within 1-2 days is pretty awesome and this is a big driver of why Amazon owns 93.4% of our sales.

-

Advertising – Depending on what website A/B testing they’re doing, as many as 6 out of the top 7 results in an Amazon search can be advertising. Even when a customer searches for your brand, if you want to be seen before your competition, you need to pay Amazon. We paid them 3.55% of our Amazon revenue in 2020. As less competitive marketplaces, we did not see the need to pay for advertising on eBay or Walmart.

On Amazon, on the left, the top four search results are advertising. Walmart, on the right has no advertising for the same search.

Based on what I’ve seen, the typical established Amazon seller has margins of around 15%. At that level of margin, moving your sales from Amazon to eBay would result in a 38% improvement in profits, which is huge. Shifting those sales from Amazon to one’s own website would represent a more than 3x increase in profits! Of course, if this were easy, we would have done it already. Unfortunately, getting traffic to one’s website is oftentimes a costly affair and it could be expected that a good portion of those profits would go to Facebook or Google.

Logistics and Covid-19 or Why It’s Better to Be Lucky Than Good

When the lockdowns first hit in the United States, it caused a massive shift in spending from brick-and-mortar to e-commerce. When government assistance arrived, it turbocharged online consumer spending even further. So for almost everyone in the e-commerce industry, 2020 was the best year they’ve ever had.

That said, it was a logistics nightmare, all year. And as a result, the rewards of this e-commerce boom were not spread evenly across all channels throughout the year.

This is a graph of orders shipping out of our warehouse 2020 vs. 2019. Note that the scale on the left is different for each year. We shipped nearly 6x as much out of our warehouse in 2020.

On or around 03/18/2020, Amazon’s 2 day prime became 30 day prime, and as a result our shipping volume shifted away from their fulfillment centers to our warehouse. It seems also to have caused would-be Amazon customers to shift their purchasing volume to other websites, like Walmart.com, which for us increased its year over year sales 5.38x.

We were lucky to see massive growth on Amazon.com for most of 2020.

From 01/01/2020 through 11/26/2020 our sales were up 75% on Amazon.com, but headaches for Amazon reappeared again around Black Friday to Cyber Monday weekend. From 11/27/2020 through 12/31/2020 sales were up only 20% over 2019’s same period. From 12/15/2020 through the end of the year, our sales in 2020 were lower than they were in 2019. For a year when e-commerce was up nearly double, that is indicative of a pretty serious problem.

We were expecting a huge end of year, especially as toy sellers, but Christmas never came.

Notice what happened on 12/15/2020. That’s when our units shipped fell below 2019’s. It’s unclear what happened, but I suspect that Amazon’s shipping from their warehouses was slower than in years past and as a result, people, no longer confident that they could receive their gifts in time for Christmas, reduced their purchasing on Amazon.com.

Review Inflation on Amazon.com

With Amazon accounting for 93.4% of our sales, it also accounts for 93.4% of our focus. In analyzing our year, one of things that I noticed was that some of our best sellers had lost traction. Items that we had been selling profitably since 2014, started to sell a lot less well relative to the competition. What happened? I suspect review inflation (not be confused with fake reviews, which is a separate issue).

Click the stars to rate the item. You don’t even need to say anything about the product. Your star rating will appear. This makes reviewing easier.

One of the best ways to get someone to buy your product is social proof. One way to establish social proof is to have a lot of reviews for your item. Again, it’s not just the quality of the reviews, but the quantity that is important to customers trying to make a decision. Our older items had a lot of reviews, given that they had been sold since 2014. However, Amazon implemented a change. They’ve lowered the bar to reviewing, by offering the new rating feature.

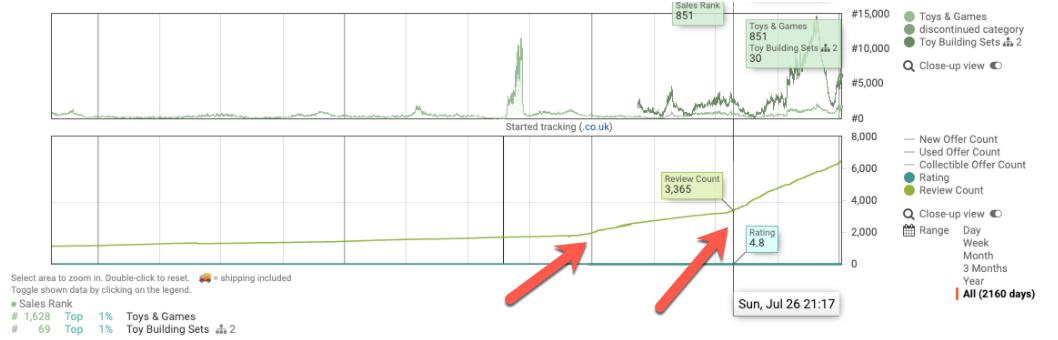

The stable light-green line is a graph of the number of reviews on of our best sellers had over the past couple of years.

You can see that reviews started to rise in 2020, which makes sense, given that there was a massive acceleration in sales and more sales means more reviews, but then in late July, things got really crazy. For us, this meant that newer competing products could “catch up” with our older established products, and as a result ours lost ground. It’s unclear why Amazon did this. Perhaps it was to combat their fake review problem, or perhaps it was to increase the social proof on their website, to make it look like a lot more purchases were happening on Amazon.com than Walmart.com.

Other Interesting E-commerce Observations

-

$4.6 million dollars worth of product were added to carts on our website in 2020. We finished the year with $97,000 in sales.

-

The conversion rate on our website was 0.7% in 2020. The conversion rate for a typical Amazon item for us is about 40%.

-

There is huge variability in what sells well on different sales channels. The #5 best seller on Walmart.com was #72 on Amazon. Our best seller on Amazon, Brain Flakes® Interlocking Discs sold over 88,000 units on Amazon in 2020. We sold 20 units over the same period on eBay. This may be because there are different customers on the platform (Walmart feels older and more rural, while eBay users love cheap returns), but it’s also because products develop a review moat. The more reviews a product gets, the more likely people are to buy it. The more likely they are to buy it, the higher it appears in search. The higher it appears in search, the more sales it will have. The more sales it gets, the more reviews…and the cycle repeats!

-

Despite heroic efforts to fight it, our ad spend on Amazon just keeps going up (on a total basis, fortunately not on a % of sales). Hard to prevent that from happening when they keep allocating more and more organic search results over to their paid platform.

-

In 2013, Amazon’s expenses as a percent of Amazon sales were 33.16%. In 2018 They were 49.70%. In 2020 they were 51.75%. Meanwhile our sales on the platform have gone up 370x. Normally, that would mean that you could lower your expenses with the company, given that you were spending so much money with them. Not with Amazon!

-

We paid an eye-watering $3.56 million to Amazon in 2020. $1.3 million of that was just for us to appear in search (commissions and advertising), a product which for them has 0 marginal cost. Amazon is also probably making quite a bit of money on shipping. Our shipping and fulfillment costs are roughly the same as what they charge to ship and fulfill themselves. With their volume and automation, they are almost certainly paying significantly less. Additionally, storage at their fulfillment centers during the holidays is a comical 28x the cost of storage at our own warehouse.

-

Sometimes you get lucky. We got lucky with the shift from brick-and-mortar to ecommerce and then the gov’t assistance, and then we got lucky further still. In the middle of October, sales for tiger plush just went off like a rocket. No one could figure out why, until we saw this:

Tiger King costumes!

Wrapping up…

It was an interesting year for e-commerce. On the one hand, it was fantastic to have our sales grow as much as they did (up ~66%!), but it was enormously difficult to manage the logistics that was necessary to make that happen. As we go into 2021, consumer spending is weak and the cost of moving a container from Asia to the United States has over doubled. Hopefully, we will be able to adapt and thrive as well in 2021 as we did in 2020!

This article grew out of a year-end analysis I did on our business. If you’ve got suggestions for how we can improve, drop me a line on twitter or contact me here! Thanks for reading and happy new year!

Some of the Viahart team at our warehouse in Texas!