Mapping the Brutal Subscription Battlefield – Monday Note

Subscription is the model of the moment for news. But the field is taken over by large players who will spare no expenses to erect the most robust barriers to entry.

(This is part 2/2 of our series on subscriptions, also read: “Winners and losers of the subscription frenzy”)

The subscription model spreads like weeds. Just look at your phone screen and consider the services that are or could be linked to a sub: music, storage, apps, games, services like parking, mobility, fitness…

While researching for this column, I found an app called Bobby, dedicated to managing and keeping track of your subscriptions. The fact that there is a need for such a product is eloquent. Two things struck me: in the screenshots used to demo the app, there is not a single news product featured. Second, the mockup amount shown in the visuals: the ballpark seems to be in the hundreds of dollars spent each month in various paid-for services…

By switching massively to a subscription model, the news sector is exposing itself to a crushing competition that can be mapped in two dimensions: the amount of discretionary income a person or a household can allocate to information (general, local, specialized) and the time that can be devoted to news consumption.

The former is not new. Twenty years ago, you could argue that the spending for the subscription of a national or regional newspaper (plus a magazine or two), was done against other expenses. True. However, two shifts have occurred. The first one is the reversal in the revenue model for news. Twenty years ago, a 25 cents newspaper (less than 40 cents,inflation-adjusted), was based on a revenue split of 80 percent for advertising and 20 percent for circulation. Today’s ratios are inverted: 30 percent for ad and 70 percent for circulation. The survival of the news media industry that produces original and verified editorial needs to tap into the readers pocket, in a recurring way. The problem is, many players want to do the same, and they spare no expenses to capture their share of the market.

On the time spent-side, the situation is tricky. Unlike money allocation, time can’t be expanded. Except considering competing with sleep, as Netflix CEO Reed Hastings boasts: “You get a show or a movie you’re really dying to watch, and you end up staying up late at night, so we actually compete with sleep. And we’re winning!”

Precisely, let’s take the case of Streaming Video on Demand (SVOD). A year ago, Deloitte published a compelling study (emphasis mine):

55 percent of U.S. households now subscribe to at least one video streaming service, a 450 percent increase since 2009.

On average, Americans watch 38 hours per week of video content (39 percent of which is streamed), nearly the equivalent of a full-time job. With over 200 SVOD options in the U.S., the average streaming video subscriber is paying for three services resulting in U.S. consumers collectively spending $2.1 billion per month on SVOD services. High-quality original content appears to be driving an increase in streaming with nearly half (48 percent) of all U.S. consumers streaming television content every day or weekly, up 11 percent year-over-year.

Netflix consumption is 1h36 per day, and its at-once release of TV series translates into 70 percent of all US viewers and 90 percent of the millennials consuming 5 episodes per sitting (Showtime releasing one by one the episodes of the fourth season of Billions drives me nuts, personally).

Still on time spent: Spotify eats each 44 min or a day; social interactions more than 2h. Taking in account gaming, the picture is even worse: users of the Amazon-owned platform Twitch spend 1h30 per day; and one-third of Fortnite players spend 6 to 10 hours a week, 38 percent more than 10 hours a week — and two-third have bought various extras on the game for $85 on average…

Viewing these staggering number, selling subscriptions requires a serious leap of faith.

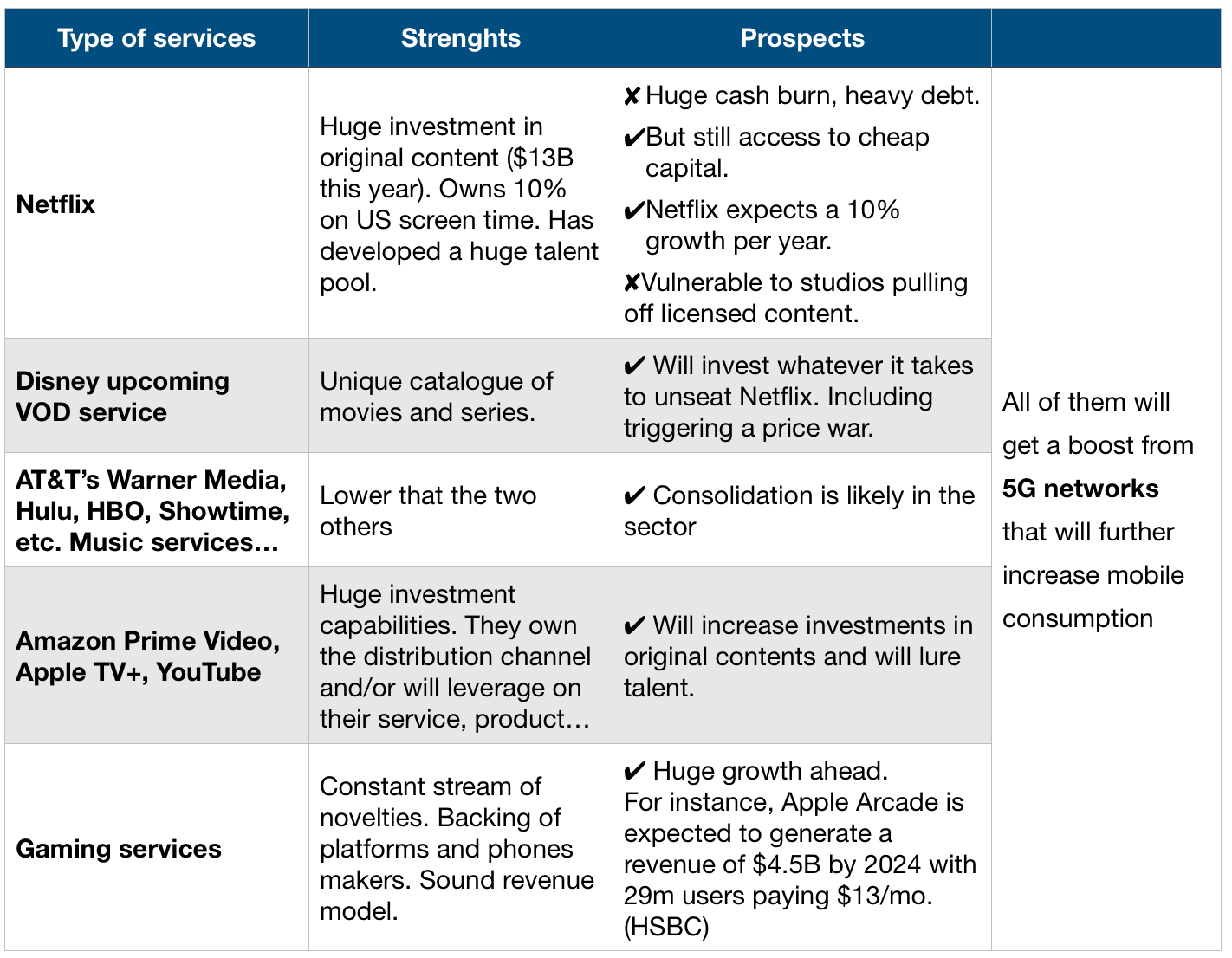

Below is a summary of different services competing against the media industry for money and time spent.

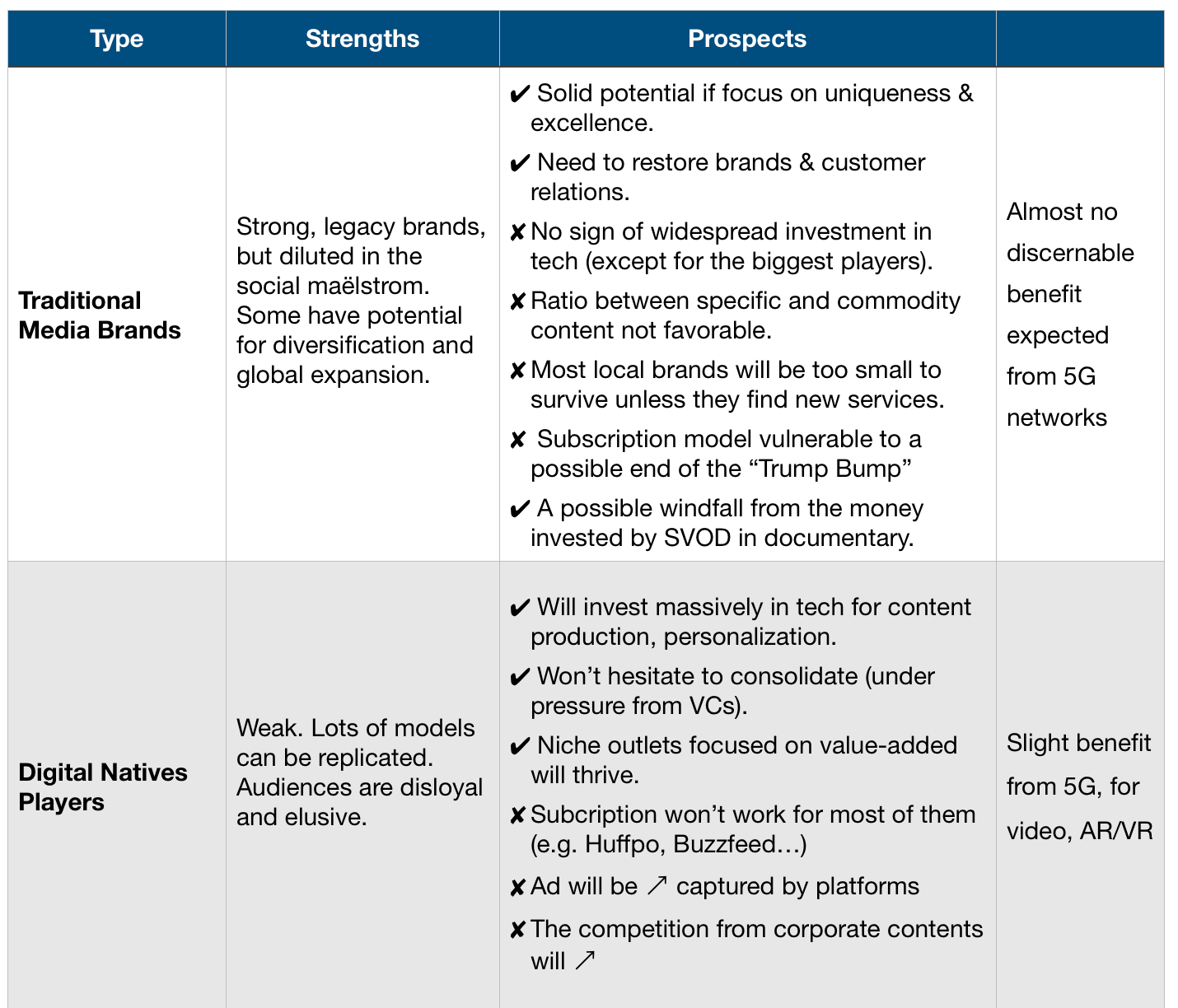

Where does the media industry fit in this picture?

My (temporary) conclusion is that the news media sector can still pull things off if it focuses on its core product value, invests in tech, stops treating its customers like an airline its passengers. Also, the media should cease begging for public and private subsidies, whining about platforms (Margrethe Vestager don’t write paychecks). It is time for acceptance in the Buddhist way: What is is.