The Squid & the Whale

Amazon swims towards $1 trillion…

Earlier this month, Amazon’s stock price eclipsed $900-a-share for the first time. The company is now valued around $430 billion. And with the run, founder/CEO Jeff Bezos is now the second wealthiest person in the world.

And he’s surely going to be the wealthiest soon. Even as he sells off billions of dollars of shares to invest in space travel. Because it sure feels like Amazon still has room to grow. Possibly a lot of room. Which is crazy.

Amazon, for my money, is the most interesting company operating today. Even valued north of $400 billion, it feels cheap. Because they’re not only doing so much, they’re doing so much well. They’re out-executing pretty much everyone, and they’re doing it at incredible scale. A trillion dollar valuation doesn’t seem absolutely insane. Which is insane.

Crazy. Insane. Crazy. Insane. These descriptors seem to be the norm for Amazon these days. At least for those of us watching from afar. To those who are closer, there are different descriptors. More on that below.

You could write an entire book about Amazon — Brad Stone did! — and still not be able to cover everything interesting they’re doing. So an attempt in 500(ish) words is feeble. But I truly believe that they, alongside Netflix (and to a slightly lesser extent, Tesla) are the most fascinating companies operating at scale right now. The Squid and the Whale.

And, undoubtedly not coincidentally, there’s increasing overlap between the two in one of the more visible and high-profile battlegrounds: content. Watching Netflix become a major Hollywood player has been fun, but not all that surprising. This is their world after all. Amazon winning Oscars seems far more unlikely.

And yet not.

They’re doing so many different things, but there are common threads that tie them all together. Amazon Prime. The Cloud. Etc. But Amazon is one of the only companies that seems able to tie such wide-ranging areas together in such a cohesive package that not only makes sense, but sets a standard for efficiency and execution.

How the hell is the company that used to sell books online and where I now buy toothpaste also powering the backend for most of the tech services I use every day — and making Oscar-winning films? When the CEO of said company is busy winning a game of chess when you think you’re watching a game of checkers.

Those magical stores where you just walk in and walk out, item in hand, without ever waiting in line to pay, may have some kinks to work out. But those kinks will be worked out. Is there really any question that this is the way this should be done in a world where every single person has a super computer in their pocket? Have you used Uber? Would you bet against this? Would you bet against this company doing this?

This is the company that effectively killed the big bookstores and then started opening big bookstores. They’re pissing on those grave sites to water the seedlings from the trees they chopped down. Ruthless. Brilliant. Amazon.¹

Most of the time, when you hear about a company the size of Amazon moving into a new space, eyes roll but heads don’t. But when Amazon moves into your space, it’s fucking terrifying. Because they execute.

As Amazon continues to push into Netflix’s video airspace, Reed Hastings recently noted:

“I feel like we’re competing with an unusual person. Because Jeff’s there, it’s kind of scary.”

Yes, there are missteps here and there. The Fire Phone comes to mind — a misstep that should have been fairly obvious. But Bezos literally does not care about such misses. Which is obviously the right mentality to have, but is so much harder to pull off — see: basically every other company, where hesitancy, reluctance, and doubt creeps in after a big miss. He’s like the quarterback who not only shakes off the bad interception, but realizes there’s nothing to shake off. It literally will not matter as long as you throw more touchdowns. Just keep throwing.

As The Economist recently noted:

Credit Suisse calculates that only ten firms with sales of more than $50bn have managed to grow by an average of 15% or more for ten years straight since 1950; no company with sales of more than $100bn has done so. If Amazon were to pull it off, it would be the most aggressive expansion of a giant company in the history of modern business.

Are we going to bet against this with Amazon? Really? No, we are not.

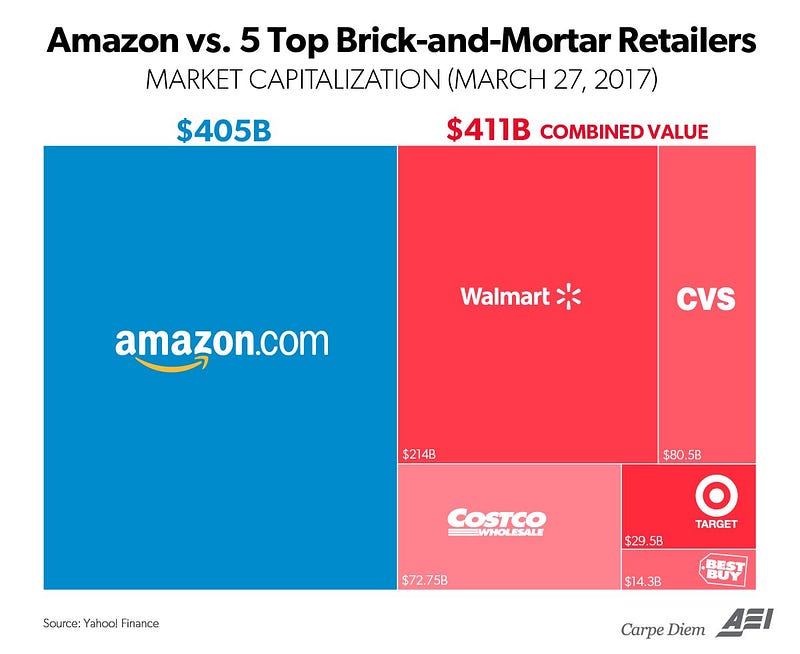

The chart below (by way of Mark J. Perry on Twitter), isn’t surprising in the least. Just wait until Amazon is full on (out) competing with FedEx and other shipping companies. Drones. Alexa. Etc. And god knows what else.

Well, one person knows. And he doesn’t really hint at such things in his brilliant annual shareholder letters. He just lays out a straightforward, high-level vision. And then executes. The Whale.

¹ While Amazon clearly mortally wounded Borders, Barnes & Noble, and the like, the smaller, independent bookstores are now thriving in this world. So should we be upset about what Amazon did?